VAT Rules for Cross-Border Shipments

Effective 1st June 2025, VAT treatment for cross-border shipments is now based on your billing country rather than the shipping destination.

This change helps ensure compliance with updated EU tax regulations, including the use of triangulation and reverse charge mechanisms, depending on your VAT registration status.

What’s Changed?

- The order type is now based on the billing country.This determines how VAT is applied — shipping destination no longer impacts VAT logic.

- Triangulation and reverse-charge logic apply when conditions are met.This may result in 0% VAT being charged when valid EU VAT numbers are provided.

What Does It Mean?

- If you are in the EU (excluding the Czech Republic), have a valid EU VAT number, and your order ships from Czech Republic to another EU country, triangulation applies, resulting in a 0% VAT fee.

- If your billing and shipping addresses are in the same EU country and you provide a valid EU VAT number, the reverse charge applies, resulting in a 0% VAT fee.

- If no valid VAT number is provided, the standard VAT fee of 21% for Czech Republic is charged.

To avoid unnecessary VAT charges:

- Please make sure your account includes a valid, VIES-validated EU VAT number.

- If needed, update your VAT details in your customer profile before placing your order.

- Ensure that your billing country is accurate — this determines how your order is processed.

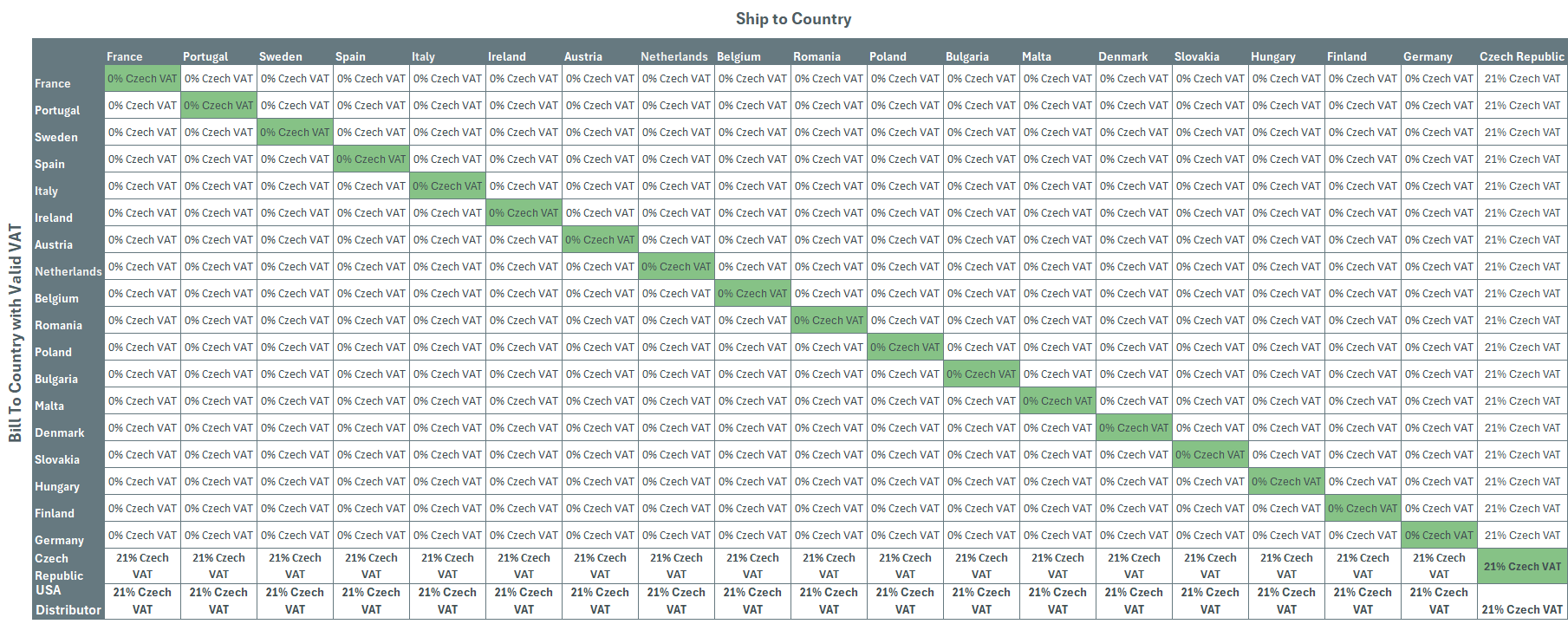

How can I know what VAT will be applied to my order?

- I do have a valid VAT number for the billing country – Check VAT rules below:

What are the exceptions?

VAT is always charged in the following cases:

- Shipping to the United Kingdom results in a 20% UK VAT fee.

- Shipping to Switzerland results in an 8.1% Swiss VAT fee.

- Shipping to Norway results in a 25% Norwegian VAT fee.

- If no valid VAT number provided, the standard 21% Czech VAT fee is charged.

Please note: In these cases, Goldstar imports the goods into the destination country and completes a local transaction. Therefore, the applicable local VAT must be charged.

Please ensure that your VAT registration details are up to date to prevent any disruptions in your ordering process.

If you need assistance in updating your VAT registration or have any questions regarding this change, feel free to contact our customer service team.